S h a r e

Why salary sacrifice is the new cash for car

Posted by

Grant Boardman

April 2023

Not so long ago, the talking point for fleets was whether a cash alternative was better than taking a company car.

Driven by escalating benefit in kind company car tax, many drivers decided that they would rather take the cash, thank you very much, and spend it on a car how they wanted.

To be fair there was little HR departments could do to offer anything other than a cash alternative, even though fleet managers flagged up their concern over duty of care and loss of control over grey fleet cars.

Today, though, the extremely low taxation of electric and ultra low emission company cars means a reversal in fortunes for the cash for car option. Many of those cash takers are moving back into plug-in company cars because the benefit in kind is currently as low as 2%.

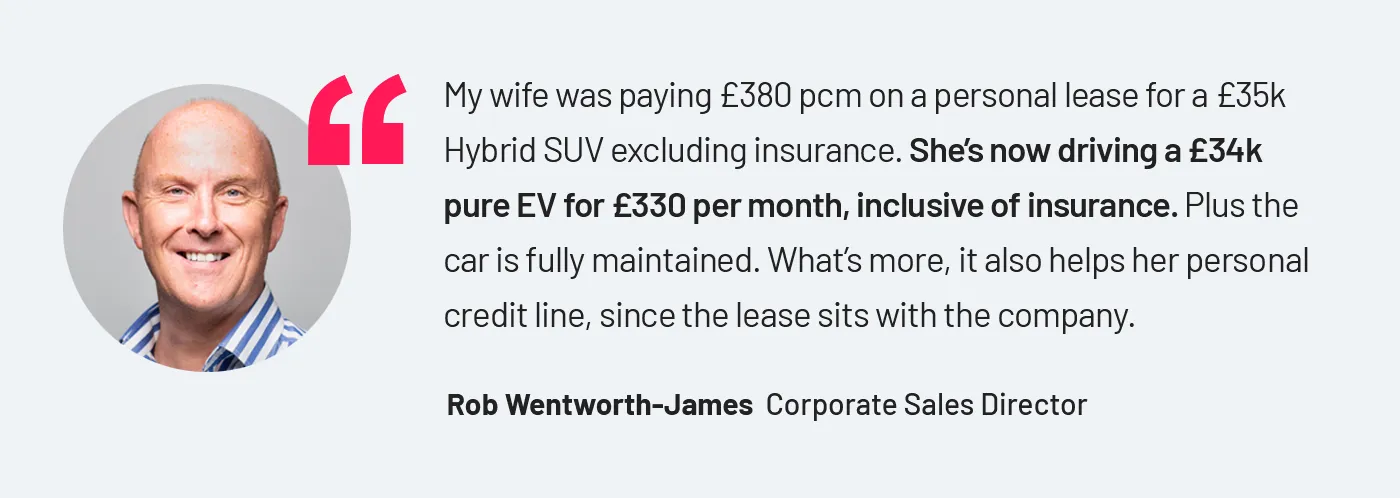

Rob Wentworth-James, Fleet Alliance’s Corporate Sales Director, gives his own experience of the dramatic change in taxation:

“I was in an Audi A5 3.0 TDI but the benefit in kind had become unsustainable, no matter how much I liked the car. By switching to an electric company car – a Tesla Model 3 – I saved over £400 a month in tax.”

Once the fleet buzzword, cash for car is no longer the case; it has changed to salary sacrifice.

For those drivers unable to walk back into a company car, many HR departments are offering salary sacrifice instead, whereby drivers sacrifice part of their gross salary for a leased EV. Payments are taken from a driver’s gross salary, which reduces the income tax and National Insurance contributions (NIC) payable by the driver.

There is still benefit in kind tax to pay, but because the tax on electric cars is so low, it remains an extremely viable option and highly tax-effective. It is also cheaper than acquiring a car on personal lease. So there are significant gains all round.

Here’s Rob’s experience again:

“My wife was paying £380 pcm on a personal lease for a £29k hybrid SUV excluding insurance. She’s now driving a £34k pure EV on the same period and mileage for £330 per month, inclusive of insurance. A saving of £90 per month on the lease and insurance cost. What’s more, it also helps her personal credit record, since the lease sits with the company.”

Salary sacrifice is an increasingly important part of the HR team toolkit, not only to attract new staff in a highly competitive employee marketplace, but also to retain staff.

How competitive tendering lowers business costs for salary sacrifice

So, the role of salary sacrifice as an HR tool is increasingly valued. But Fleet Alliance can help make it an even more compelling offering, thanks to its unique competitive tendering process, which lowers the lease cost of acquiring the EV for the employer and also means less gross salary to sacrifice for the employee.

With the Fleet Alliance salary sacrifice scheme, employees choose their car which is then tendered to a panel of some of the most competitive contract hirers in the market, and the cheapest lease rental wins the order. This tender process usually saves clients between 6% and 12% of the lease cost, so it proactively helps reduce business costs.

Too good to be true? If there is one sticking point with salary sacrifice it’s over the risk of early termination should an employee seek to change employment. But this risk can be reduced to negligible, argues Rob, if the employer ‘banks’ the NIC savings. These can then be deployed in the event of early termination.

“It’s highly effective,” asserts Rob. “Early termination remains an understandable concern for businesses looking to introduce salary sacrifice, but taking this route effectively eliminates the issue, and for all clients we can model how this works.”

Comparing cash v car and salary sacrifice

If you compare the positions of an employee on a cash for car scheme, the advantages become apparent that salary sacrifice offers a number of advantages.

To start with we’ll take the comparison between an Audi Q3 model, the plug-in hybrid model on salary sacrifice and the cash for car Q3 a petrol model.

Salary sacrifice

Audi Q4 e-tron 250kW eDrive40 Sport 83.9kWh 5dr Auto

Cash for car

Audi Q3 35 TFSI S Line 5dr

The monthly difference in net monthly income saved is £44.25, offering a saving of more than £1500 over the three year lease period. In addition, the running costs on electricity – especially if charged at home – will be significantly in favour of the PHEV Q3, while the employee also reduces their personal credit exposure.

Let’s turn to another comparison, this time a petrol BMW 3 services versus an all-electric BMW i4.

More than the Q3 PHEV above, the running costs on cheaper electricity will provide even greater savings for the salary sacrifice taker. So let’s see how the savings on salary sacrifice pan out.

Salary sacrifice

BMW i4 250kW eDrive40 Sport 83.9kWh 5dr Auto (£56,130)

Cash for car

BMW 3 Series 320i Sport 4dr Step Auto (£38,704)

The savings per month by taking salary sacrifice are over £100 a month with a total positive bank balance of £3654 over the three year period of the rental agreement.

With employee savings like this, it’s little wonder that salary sacrifice is becoming such a popular option for HR departments, and our spin which includes competitive tendering, is making it even more attractive to clients and their employees.

If you add in the advantages of zero tailpipe emissions on an electric car salary sacrifice to an employer’s Environmental, Social and Governance (ESG) programme, then it’s not difficult to see why salary sacrifice is the new cash for car in fleet.

You also might like…

If you liked this article then check out our posts about similar topics

The Fleet Management MOT: 7 Key Inspection Points

You wouldn’t run a vehicle without an MOT, yet many fleets run for years without ever inspecting the company managing ...

EVs – what’s coming next in 2026

There’s seemingly no stopping the flow of new electric cars (EVs), as a greater variety of models, new entrants contin...

We do the Salary Sacrifice thinking for Mortgage Brain

The people at Mortgage Brain spend all day working on mortgage technology to help intermediaries and lenders, so when th...

First Drive: New Tiggo 8 Is A Chery Worth Picking

Why it matters The Chery Tiggo 8 is one of the most talked-about new arrivals in the UK In just four months, the brand ...

When “Good Enough” Fleet Management Stops Being Good Enough

Every year, UK organisations talk about efficiency, governance and value for money Yet behind the board reports and b...

A New Year’s Resolution for Smarter Fleet Management

Every January, businesses everywhere make the same promises: cut costs, simplify operations, do more with less But if...

2025 Wrapped: My First Year as a Fleet Alliance Appointed Representative

As 2025 draws to a close, it feels like the right time to pause, take stock, and look back on my first year as an Appoin...

FRED 82: Turning a Compliance Challenge into a Fleet Opportunity

FRED 82 may look like just another accounting standard, but for organisations running sizeable vehicle fleets, it repres...

Ready to make the management of your fleet more efficient?

Request a call back