S h a r e

Company Car Tax for Electric Vehicles

Posted by

Kevin Blackmore

January 2020

The amount a company car driver pays in company car tax is directly affected by the CO2 output of the vehicle they drive. As such, the Government is able to influence uptake of low emitting vehicles by setting BIK rates to favour low-emitting vehicles.

Benefit in Kind (BIK) for company cars is calculated based on three factors:

- The P11D price of the vehicle

- The vehicle’s CO2 emissions

- The employee’s tax band

The BIK levied on battery electric (BEV) and Plug-in Hybrid electric vehicles (PHEV) will fall dramatically from April 2020. For Battery Electric Vehicles in particular, the BIK rate falls from 16% to 0% in 2020/21 rising to 2% in 2022/23. This makes BEVs an extremely tax-efficient option.

Plug-in hybrids also enjoy low BIK. Lower rates apply to varying degrees for all plug-in electric vehicles depending on the distance they can travel on battery power alone. Plug-in hybrid vehicles capable of an electric-only range of over 130 miles benefit the most. For

WLTP

From 6th April 2020 CO2 emission figures will be based on the newer Worldwide Harmonised Light Vehicle Test Procedure (WLTP) standards. WLTP replaces the outdated New European Driving Cycle (NEDC) standard which did not accurately reflect real-world driving conditions when calculating CO2, NOx emissions and fuel efficiency.

As a result of this, the government has published two BIK rate tables – one for vehicles registered before April 2020 and one for vehicles registered on or after this date.

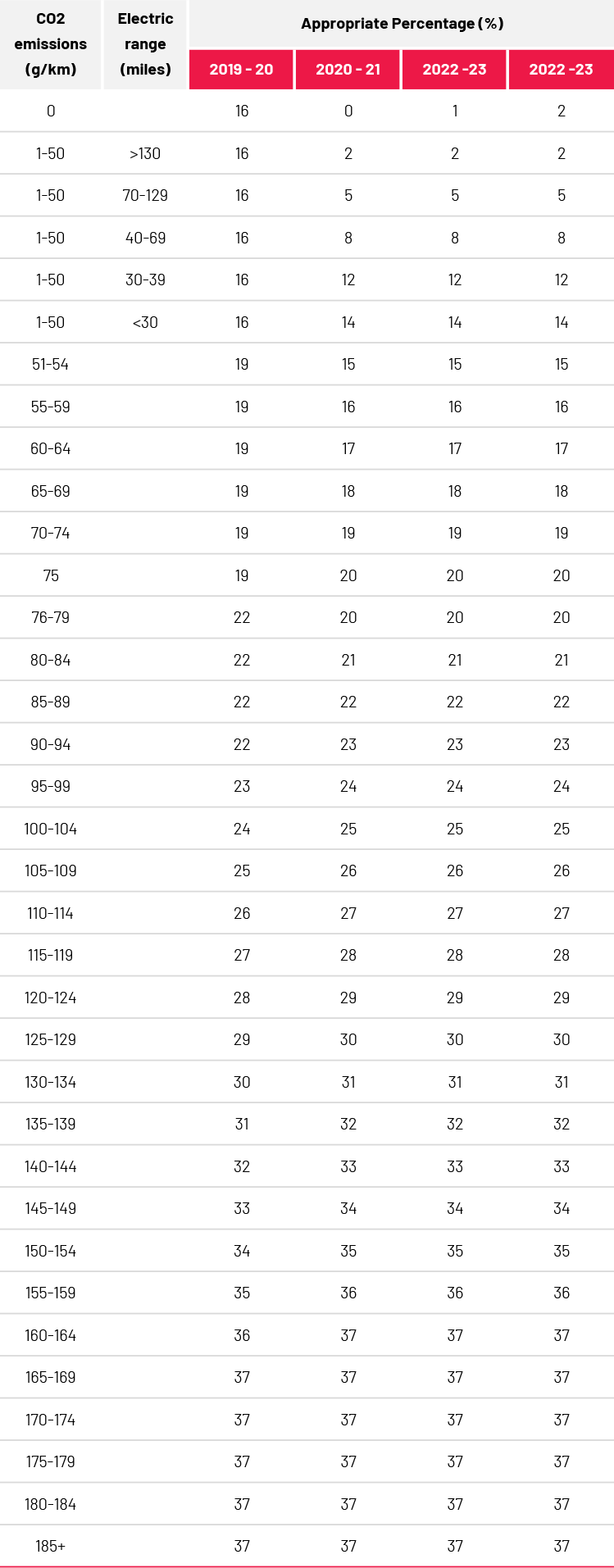

BIK rates for cars registered before 6th April 2020

The table below shows the percentage BiK rates based on CO2 emissions. The tables cover electric, petrol and diesel vehicles. Note: 4% should be added to the appropriate BIK percentage for diesel cars that are not Real Driving Emissions 2 (RDE2) compliant.

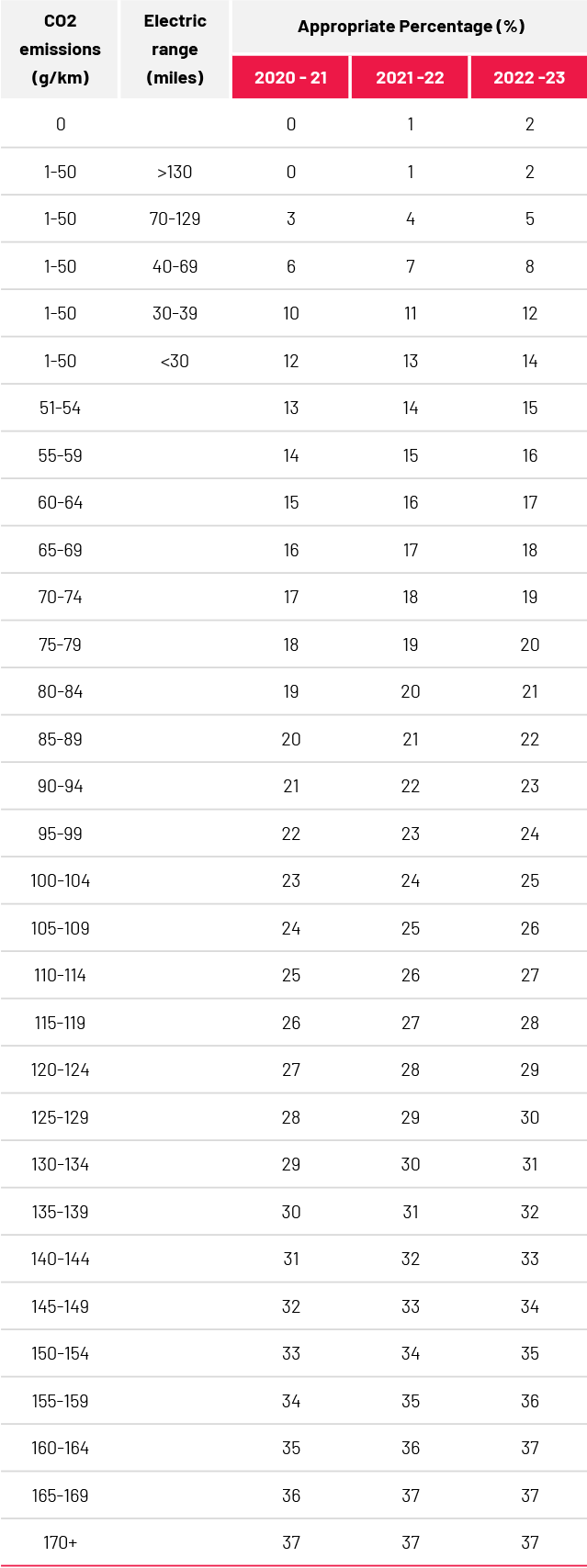

BIK rates for cars registered on or after 6th April 2020

The table below shows the percentage BiK rates based on CO2 emissions. The tables cover electric, petrol and diesel vehicles. Note: 4% should be added to the appropriate BIK percentage for diesel cars that are not Real Driving Emissions 2 (RDE2) compliant.

Note: While this guide focusses on BIK on electric company cars, BIK is also applicable to electricity provided at an employee’s workplace. However, this is currently rated at 0%.