S h a r e

Don’t ditch the company car for cash. Here’s why

Posted by

Rob Wentworth-James

December 2020

Is your company considering the future of company car provision? We wouldn’t be surprised. There are plenty of reasons why many companies are rethinking this element of the remuneration package for employees.

Such changes are being driven by the clamour from company car drivers about excessive benefit in kind taxation levels.

You can understand why.

Let’s take a BMW 320d over a series of three-year leasing life cycles, starting 2014 and going up to and including 2020. If we consider the BIK paid in the 2014 tax year to the BIK paid in the 2020 tax year, the increase has been 2.5 times for a driver at the 40% marginal rate. Meanwhile, the BMW’s percentage BIK rate tax banding has risen from 14% to 27% during the period.

Here are the figures:

- BMW 320d EfficientDynamics Business – tax payable @ 40% in 2014: £1669

- BMW 320d ED Sport Sport-Auto – tax payable @ 40% in 2017: £2529

- BMW 320d Sport Auto – tax payable @ 40% in 2020: £4042

Meanwhile, the list price has risen from £29,810 in 2014 to £37,430 today, with consequential uplifts in monthly contract hire rentals.

Removing the company car and recompensing the driver with cash is seemingly an easy way to settle the issue at a stroke. While the costs to the business will probably remain neutral if like for like is provided, the driver no longer pays the company car tax. There will still be tax to pay on the additional cash as well as extra National Insurance contributions. (And it should be remembered that with a cash-for-car policy, the employee has to extend their own personal credit lines to access a similar car on a PCH agreement.). But the friction point – the amount of BIK paid – is smoothed out.

But there remain issues for the business, nevertheless. These include the employer’s duty of care to manage these cash-for-car vehicles if they are used on business (called ‘grey fleet’ cars), such as ensuring drivers have the correct insurance for business use, driving licences remain valid, and regular vehicle inspections are carried out.

So, for an employer, the gains made by offering cash have to be balanced against more complex management and administration of the new grey fleet.

But it doesn’t have to be that way.

Reverse the rises. Here’s how

The fleet can be managed in a very different way, by looking at the overall cost of the vehicle – called the Whole Life Cost – rather than just focusing on the monthly rental.

By understanding the full running cost of a company car – this includes the rental, maintenance, fuel, insurance and Class 1A NIC minus the reductions made for VAT recovery and tax relief where applicable – a much clearer understanding of the actual costs to the business emerge.

But moving away from a fleet policy based on rentals, to one based on WLC is just one element of the change in the fleet management process. In addition, enterprises need to start transitioning from traditional petrol and diesel vehicles to plug-in electric vehicles (PHEVs) and fully electric vehicles (EVs).

There are two good reasons to encourage businesses to make the transition. The first is the ban on petrol and diesel combustion engines, effective 2030, which was announced by the Government in November. Companies must start pivoting to electrification of their fleets to meet that deadline.

The second is the benign benefit in kind company car taxation treatment of PHEVs and EVs, which will significantly reverse the tax increases experienced by employees.

Our sophisticated running cost and taxation software can assist the change, show the BIK savings

Fleet Alliance has invested in sophisticated running cost and taxation software that can demonstrate the savings to you instantly. It’s called Gensen and enables us to analyse different fleet acquisition policies.

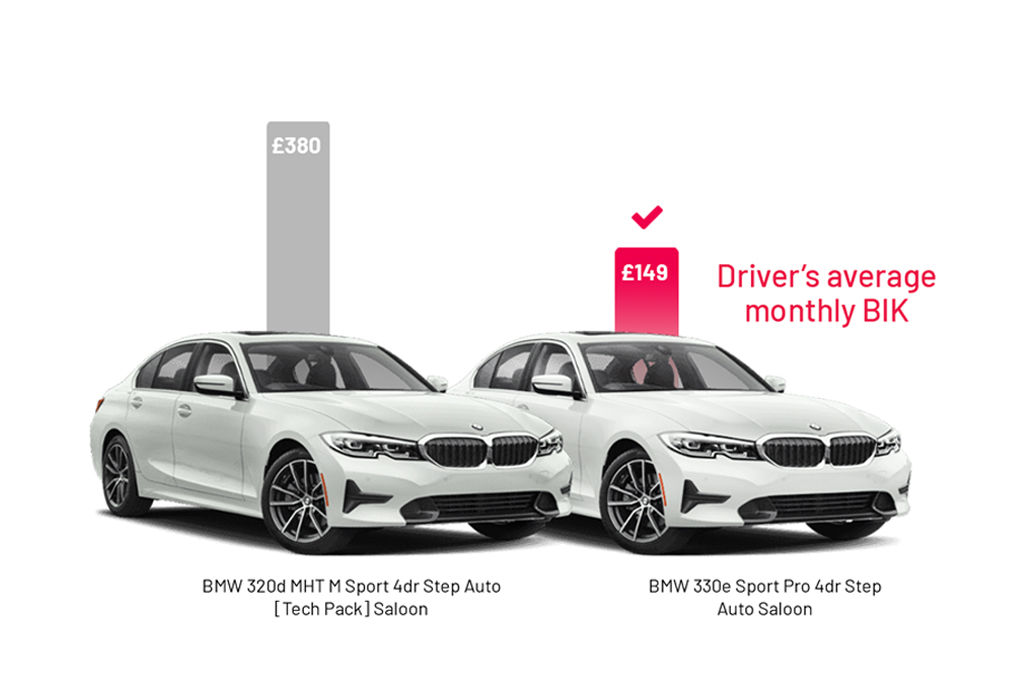

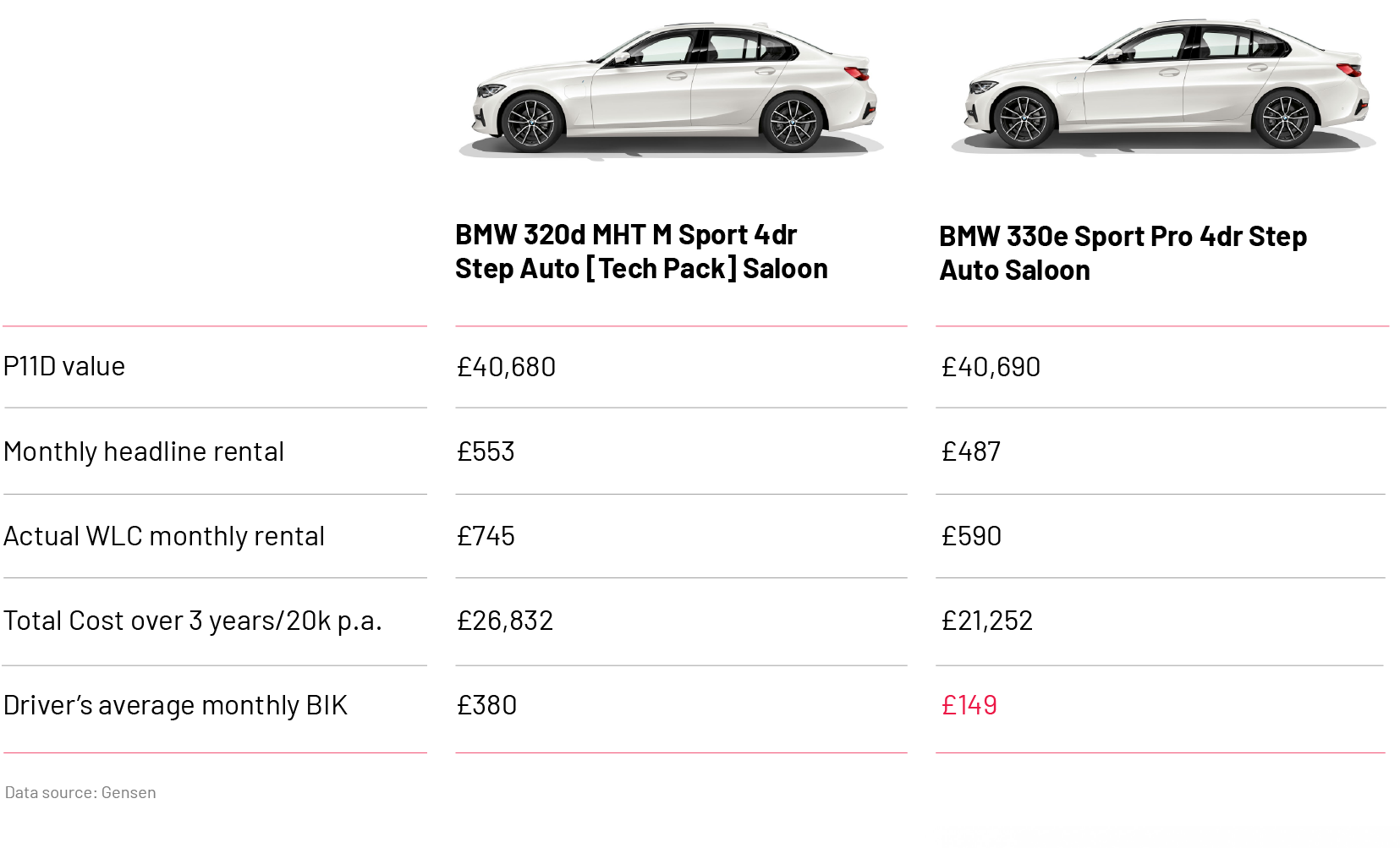

Here, for example, are how the savings can mount up based on a WLC and electrification fleet policy – again based on our BMW 3 Series diesel, but this time compared with a BMW 3 Series PHEV. Both cars have virtually identical P11D values

In this instance, the PHEV 3 Series is actually better on its monthly rental anyway, but the difference really accelerates when you have a look at the overall WLCs – a saving in excess of £5500 over the three years.

Perhaps even more marked is the enormous BIK saving made by the driver – on average the driver is £231 a month better off.

How a blended salary sacrifice scheme can help make EVs affordable

Moving from a rental-structured fleet policy to one based on electrification and Whole Life Costs, however, can lead to situations where the driver’s desired outcome is at odds with the cost of the vehicle to the company. In general, this will be the result of the higher technology cost of the latest EVs.

To rectify such issues, we have an innovative scheme of salary sacrificing some of the driver BIK saving in return for the employer’s greater cost in providing the vehicle. Again, with our software, we can demonstrate how this works and how much the driver needs to sacrifice to get an EV.

The outcome works for the driver – the amount of BIK to be paid is still greatly reduced – and keeps the employer cost neutral, while all parties benefit from investing in zero tailpipe emission technology and improving local air quality.

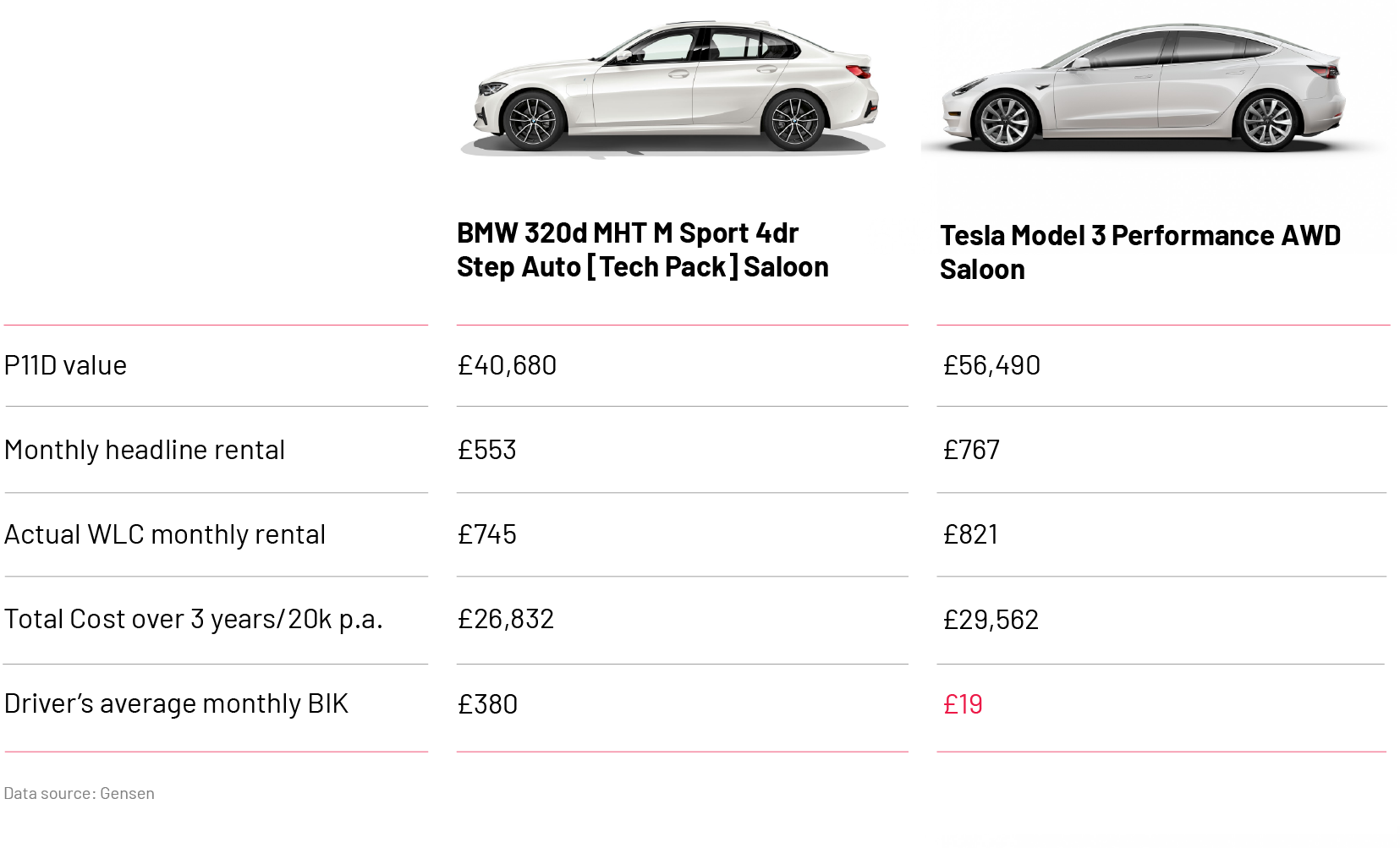

To demonstrate how this would work, let’s go back to our BMW 320d again and compare it with a Tesla Model 3 Performance edition, capable of over 300 miles on a single charge.

In this instance, because of the greater list price of the all-electric Tesla, the running costs are greater than the diesel BMW. Except for the driver benefit in kind, which has suddenly dropped to a minimal amount each month.

So how do we ensure the desired outcome – the switch to the EV Tesla – is achieved? Clearly, there is something of an imbalance now between the driver’s BIK saving and the additional cost to the company. However, this can be rectified with a blended salary sacrifice scheme.

With a blended salary sacrifice scheme, a driver sacrifices some of the BIK saving towards the additional cost of the car. This can either be an amount to provide a cost-neutral position for the company, or it could be the business shares some of the savings too.

In the above scenario, a driver would have to sacrifice £77 of gross salary for the business to remain cost-neutral.

Such a scheme is simple for payroll to set up and administer and retains the driver within a company car scheme that has successfully pivoted to electric.

Panel funding provides best rental

Having established a change of your fleet policy, Whole Life Costs can always be lowered by ensuring the business receives the best contract hire rental on the day. Fleet Alliance has a panel of funders it approaches for each company car required. Whichever funder is cheapest on the day receives the business, protecting your company from funder changes in RV underwriting policies and alterations in vehicle mix risk strategies.

So, don’t ditch the company car – talk to us

Please contact us and we can provide a no-cost analysis of how moving to an electrified and Whole Life Cost policy can benefit your fleet management costs, leave your drivers financially better off, and reduce the impact of the vehicle on local air quality.