S h a r e

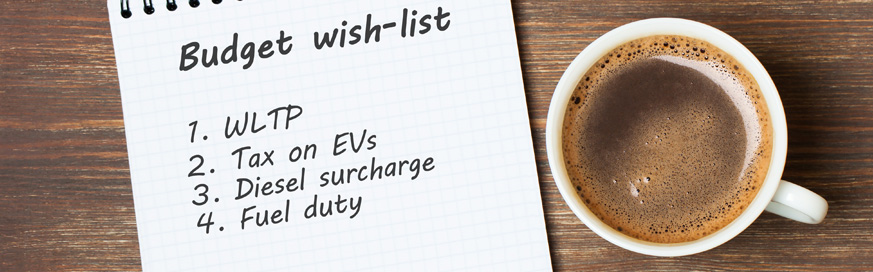

Brown’s Budget wishlist

Posted by

Martin Brown

October 2018

The Chancellor’s Budget. On a Monday? The Chancellor knows how to get the week off to a cheery start, doesn’t he?

So, what would I like to see? Well, there are several things that need fixing individually. But the overarching wish on my list is this.

Consistency.

Consistency in the Government’s approach to fleets, fleet drivers and fleet vehicles.

I want the Government to think about what it says, the actions it takes, and make them consistent. Joined up. Logical.

Let’s just take the Plug-in Car Grant as one example:

With the focus firmly on encouraging ultra low emission cars and zero emission vehicles, so strongly argued in the Government’s Road to Zero Strategy document, why suddenly cut the Grant? And, perhaps more strangely, completely remove the grant for Plug-in Hybrid Electric Vehicles (PHEVs).

After all, it was only in July that The Road to Zero strategy stated – under the sub-heading ‘We will drive uptake of the cleanest new vehicles by’ – that the Government would be “Continuing to offer grants for plug-in cars, vans, taxis and motorcycles until at least 2020. The plug-in car and van grants will be maintained at the current rates until at least October 2018. Consumer incentives in some form will continue to play a role beyond 2020.”

See what I mean about consistency?

And then there’s the treatment of electric cars under the current benefit-in-kind rules. Were, for example, a fleet driver to take an electric car (with reduced Plug-in Car Grant) then the driver would be faced with company car taxation of 16% in 2019/20 before dropping to 2% in 2020/21.

Again, it makes no logical sense. There’s a real disconnect there between stated intention and taxation policy. It needs fixing.

A simple way to do this would be to bring forward the 2020/21 tax changes that encourage ultra low emission vehicles.

Want a further example of this disjointed thinking (now you’ve got me going)?

Diesel.

Fingered by the Government as the source of virtually all evil last year, penalised with a 4% benefit in kind surcharge, and then carefully welcomed back into the fold in the Road to Zero document: “Cleaner diesel cars and vans can play an important part in reducing CO2 emissions from road transport during the transition to zero emission vehicles whilst meeting ever more stringent air quality standards.”

So why not encourage cleaner diesels with less punitive benefit in kind taxation?

Chris Grayling, Secretary of State for Transport, said in the foreword to The Road to Zero strategy that it “sets out a clear path for Britain to be a world leader in the zero emission revolution – ensuring that the UK has cleaner air, a better environment and a stronger economy.”

All I ask Mr Hammond, is that you provide us with the consistency of policy to travel down that path to zero emissions.

You also might like…

If you liked this article then check out our posts about similar topics

When charging an EV is as quick as refuelling with petrol

Imagine a charge for an electric car adding almost as many miles of range as a fill-up with petrol in about the same amo...

The Fleet Management MOT: 7 Key Inspection Points

You wouldn’t run a vehicle without an MOT, yet many fleets run for years without ever inspecting the company managing ...

EVs – what’s coming next in 2026

There’s seemingly no stopping the flow of new electric cars (EVs), as a greater variety of models, new entrants contin...

We do the Salary Sacrifice thinking for Mortgage Brain

The people at Mortgage Brain spend all day working on mortgage technology to help intermediaries and lenders, so when th...

First Drive: New Tiggo 8 Is A Chery Worth Picking

Why it matters The Chery Tiggo 8 is one of the most talked-about new arrivals in the UK In just four months, the brand ...

When “Good Enough” Fleet Management Stops Being Good Enough

Every year, UK organisations talk about efficiency, governance and value for money Yet behind the board reports and b...

A New Year’s Resolution for Smarter Fleet Management

Every January, businesses everywhere make the same promises: cut costs, simplify operations, do more with less But if...

2025 Wrapped: My First Year as a Fleet Alliance Appointed Representative

As 2025 draws to a close, it feels like the right time to pause, take stock, and look back on my first year as an Appoin...

Ready to make the management of your fleet more efficient?

Request a call back