S h a r e

Government finally announces its plans for the future of fleet

Posted by

Marc Murphy

July 2019

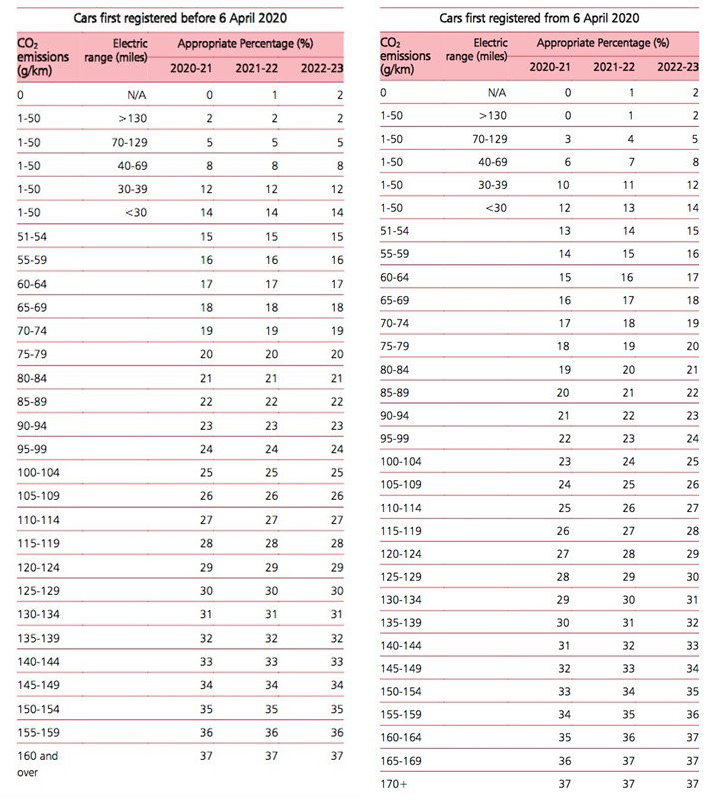

In its long-awaited response to its WLTP review, HM Treasury has scrapped the previously published BIK rates for 2020/21 and created two new BIK tables: one for company cars registered after April 6, 2020, and one for those registered before April 6, 2020.

As a result, says HM Treasury, cars first registered from April 6, 2020, should see a reduction by 2% on most company car tax rates.

At the same time, for a pure EV with zero tailpipe emissions, company car drivers will be taxed at 0%, paying no BIK tax at all. The 0% is also extended to company car drivers in pure electric vehicles registered prior to April 6, 2020, who were already looking forward to a much-reduced rate of 2% for 2020/21.

The 0% rate will also apply to company cars registered from April 6, 2020, with emissions from 1-50g/km and a pure electric mile range of 130 miles or more. Both will then increase to 1% in 2021/22 and 2% in 2022/23.

Pure electric company cars registered before April 6, 2020, will also increase to 1% and 2% in subsequent years, 2021/22 and 2022/23 – giving EV drivers three years of confirmed tax rates.

Company cars registered before April 6, 2020, with emissions from 1-50g/km and a pure electric mile range of 130 miles or more attract a 2% BIK rate in 2020/21 and stay the same for the two subsequent tax years.

In its announcement, the Government said that “by providing clarity of future with the appropriate percentages, businesses will have the ability to make more informed decisions about how they make the transition to zero-emission fleets”.

It added: “Appropriate percentages beyond 2022-23 remain under review and will be announced at future fiscal events.

“The Government aims to announce appropriate percentages at least two years ahead of implementation to provide certainty for employers, employees and fleet operators.”

The Government added that existing vehicle excise duty (VED) rates, which were not part of this review, will stay the same from April 6, 2020, despite the introduction of WLTP values for tax purposes from this date.

The Government says that a call for evidence for VED will be published later this year, seeking views on moving towards a “more dynamic approach to VED”, which recognises smaller changes in CO2 emissions.

From 2023/24, the Government says that fleet managers and company car drivers will be able to refer to a single BIK tax table again as the rates will be realigned.

Please see new tables below:

You also might like…

If you liked this article then check out our posts about similar topics

Eurocell adds huge van order to fleet following advice from Fleet Alliance

Eurocell, the UK's leading upvc window, door and conservatory manufacturer and distributor, has replaced a large proport...

Fleet Alliance archives Intelligent Car Leasing brand to focus on core fleet business

Fleet Alliance has discontinued its Intelligent Car Leasing brand, which specialised in consumer leasing The Glasgow ...

JG Pest Control updates fleet with new Peugeot Partners from Fleet Alliance

JG Pest Control, one of the country’s leading pest control operators, has updated its fleet thanks to a new batch of P...

Warp Snacks opts for EV salary sacrifice scheme with Fleet Alliance

Healthy snacks manufacturer Warp Snacks, has introduced an electric car salary sacrifice scheme for staff in conjunction...

Chancellor cuts National Insurance, extends fuel duty freeze and fully expenses leased assets

In the last Budget before the General Election, Chancellor Jeremy Hunt unveiled a series of headline-grabbing initiative...

2024 will be the year of the EV with greater supply and lower prices, says Fleet Alliance

2024 will be the year that companies look to accelerate down the electrification route, as they seek to meet their own E...

Automotive transmission specialist Xtrac opts for EV salary sacrifice scheme from Fleet Alliance

Xtrac, the world’s leading supplier of high-performance transmissions for top level motorsport and high-performance au...

Fleet Alliance reports strong uptake in EV salary sacrifice

Increasing numbers of businesses are adding the employee benefit of leasing an EV through a salary sacrifice scheme to t...

Ready to make the management of your fleet more efficient?

Request a call back