S h a r e

VED rates for Diesels are changing – we explain how you could be affected

Posted by

Kevin Blackmore

January 2018

Changes in Vehicle Excise Duty which come into effect from April may cause many companies to re-assess the mix of vehicles on their fleet in the light of the new charges.

Chancellor Philip Hammond announced in November that all new diesel cars from April 1 this year will face going up a VED band if they fail to meet the latest Euro 6 standards under real-world testing.

New cars will have to meet the real driving emissions (RDE) step 2 test that forms part of the current EU type approval process. To avoid going up a tax band new cars can pollute no higher than 1.5 times the current 80mg/km NOx limit under real-world driving conditions.

According to the Treasury’s estimates, less than two million cars will be subject to the VED band jump, though cars like the Ford Fiesta are expected to see a £20 rise in the first-year VED rates. Higher polluting models, like the Porsche Cayenne, are expected to see their first year rates go up by £500.

The changes only apply to new diesel cars, not vans, and do not impact the new £140 yearly fees all cars have to pay after the first year.

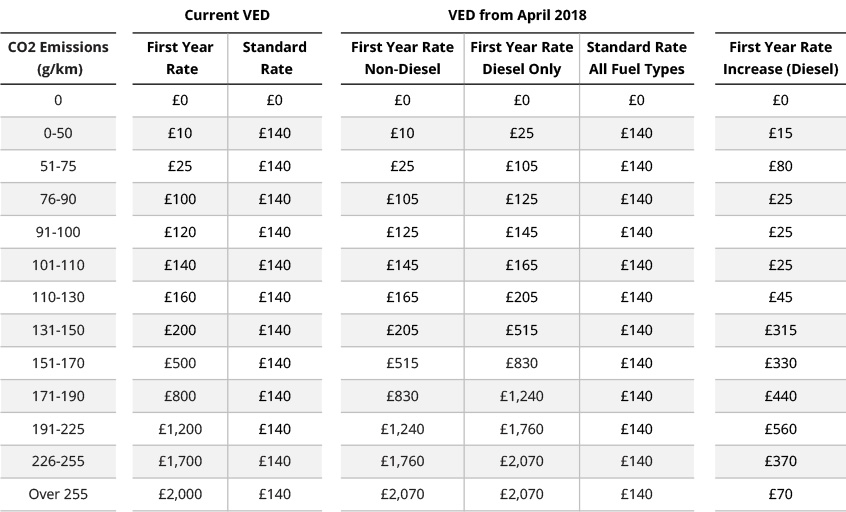

Any car failing to meet the Euro 6 standards in real world testing would move up a band, and thus pay anything from £15 to £560 more in first year rates. The new diesel rates are as follows:

Comparison of new diesel tax bands from April 2018 to current bands

Under the current VED system announced by then Chancellor, George Osborne, in the Spring Budget of 2016, new cars registered after April 1 2017 pay a one-off tax charge for the first year, based on their carbon emissions, in a CO2-based tax band system.

Compared to the pre-April 2017 tax bands, most drivers will have seen their first-year tax charge increase in the current 2017/18 year, with only zero-emissions vehicles paying nothing at all.

From the second year of ownership onwards, the CO2 scale becomes irrelevant, as two flat rates are then applied – a £0 VED rate for zero-emission vehicles only, and a flat annual rate of £140 for all other cars.

However, cars costing over £40,000 are also liable for the £140 VED rate from year two and will also be forced to pay an additional annual ‘supplement’ of £310 for five years, a total of £450 a year. Once the five-year period is over they revert to the £140 flat rate.

It’s important to note that the current tax rates only apply to new cars registered after 1 April 2017. Cars registered before that date will continue to pay the old rates.

As with the introduction of many new schemes, there are winners and losers across the board. When it was first announced, many commentators queried why Ultra Low Emission Vehicles (ULEVs) are now subject to VED, rather than being incentivised with a zero rate as before.

For example, non-diesel ULEVs emitting less than 50g/km of CO2 will from last April pay £10 in the first year of registration and £140 per year thereafter. Previously, they paid no VED at all.

The same applies to those emitting 51-75g/km. Previously paying no VED, from April 2017 they have been liable for £25 in the first year and £140 thereafter, while non-diesel cars emitting 76-90g/km now pay a charge of £105 in the first year and £140 thereafter.

Meanwhile, non-diesel cars emitting 91-100g/km, also previously zero rated, are charged at £125 in the first year, and £140 thereafter, an increase of £405 over the first three years of the vehicle’s operation.

“The new VED rules make fleet policy planning and selecting the right mix of vehicles for your fleet more important than ever before,” said Fleet Alliance managing director, Martin Brown.

You also might like…

If you liked this article then check out our posts about similar topics

Chancellor cuts National Insurance, extends fuel duty freeze and fully expenses leased assets

In the last Budget before the General Election, Chancellor Jeremy Hunt unveiled a series of headline-grabbing initiative...

2024 will be the year of the EV with greater supply and lower prices, says Fleet Alliance

2024 will be the year that companies look to accelerate down the electrification route, as they seek to meet their own E...

Automotive transmission specialist Xtrac opts for EV salary sacrifice scheme from Fleet Alliance

Xtrac, the world’s leading supplier of high-performance transmissions for top level motorsport and high-performance au...

Fleet Alliance reports strong uptake in EV salary sacrifice

Increasing numbers of businesses are adding the employee benefit of leasing an EV through a salary sacrifice scheme to t...

Edwin James Group targets carbon reduction with electric vans from Fleet Alliance

Edwin James Group has taken delivery of its first electric vans from Glasgow-based fleet management specialist, Fleet Al...

IBMG halves its carbon footprint with Fleet Alliance

The Independent Builders Merchant Group (IBMG) has seen a reduction of more than 50% in the carbon footprint of its flee...

Fleet Alliance offers new tool to help businesses assess EV readiness

Fleet Alliance, the Glasgow-based leasing and fleet management specialist, has introduced a new solution to help busines...

Spring Budget brings a welcome cut to fuel duty

Chancellor, Jeremy Hunt, brought some cheer for fleet operators when he confirmed that the 5p cut in fuel duty, announce...

Ready to make the management of your fleet more efficient?

Request a call back